Last week we have seen a massive fiscal policy response to the Coronavirus crisis. We put together the relevant resources and planning tips to share with you in this email.

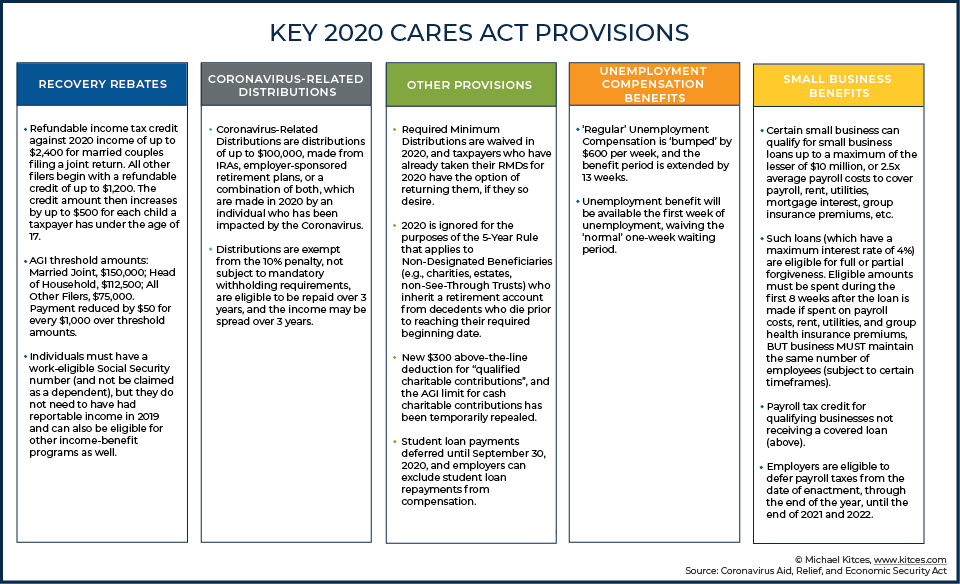

The Coronavirus Aid, Relief, and Economic Security (CARES) Act of 2020 has been enacted as of March 27, 2020. It is an estimated $2 trillion package, including nearly half a trillion dollars in individual rebate checks (akin to how the US has handled prior crises in the past 20 years), another $500B for support of several severely damaged industries, nearly $400B support including tax credits for wages and payroll tax relief, over $300B of support for state and local governments, and almost $150B for various initiatives to support hospitals and the health care system.

Below are the key provisions that are most relevant to you as individuals and business owners. Click here to see more detailed provisions.

Here are a few planning tips to consider:

Recovery Rebates

If the 2019 tax return is not filed, the 2018 tax return will be used to determine the rebate. If your 2019 tax return qualifies and is not filed yet, consider filing it as soon as possible. If neither your 2018 nor 2019 Adjusted Gross Income (AGI) qualifies, you can still receive the free check if your 2020 AGI qualifies.

Retirement Accounts

“Coronavirus-Related Distributions up to $100k ”. You have the option to spread income taxation over three years, and the ability to recontribute back to those same accounts to make up in the future.

The suspension of required minimum distributions (RMDs) in 2020 applies to beneficiaries of inherited IRAs as well. If RMD was already taken and you don’t need the cash, you should be able to roll it back but this option is not available for the RMDs already taken from inherited IRAs.

Unemployment Benefits

There is an expansion of benefits for those who would otherwise not normally qualify like self-employed individuals and independent contractors. California Unemployment Benefit has a maximum $450/week benefit. With the bump up, it can go up to $1,050/week.

Federal Student Loans

The deferral of Federal student loan payments through September 30, 2020, with no accrued interests. You need to proactively stop the payments.

For Small Business Owners

- “Paycheck Protection” loans can be forgiven if used for certain business expenses such as payrolls, rent, and utilities.

- Caveat: an individual employee’s compensation in excess of an annual salary of $100,000 will be excluded for the purposes of loan value calculation.

- You should reach out to your existing banking relationship to apply before the deadline of 6/30/2020.

Click here to see an explanation of how this program works.

- SBA Economic Injury Disaster Loan. Advance up to $10k (no repayment), 3.75% up to $2M for 30 years

- SBA Debt Relief. SBA will pay 6 months of principal and interest of current 7(a) loans.

Business owners can find out more information on these programs by visiting SBA Programs related to Coronavirus. Note: The Paycheck Protection Loan and SBA Economic Injury Disaster Loan are the two best capital resources for small business owners and consider applying for them as the first priority.

For homeowners with a Fannie Mae or Freddie Mac-owned mortgage

The Federal Housing Finance Agency (FHFA), which oversees Fannie Mae, Freddie Mac, and the Federal Home Loan banks, is providing payment forbearance to borrowers impacted by the coronavirus for up to 12 months due to hardship.

Homeowners who are adversely impacted by this national emergency may request mortgage assistance by contacting their mortgage servicer.

The following mortgage relief options are available for those who are unable to make their mortgage payments due to a decline in income:

- Providing mortgage forbearance for up to 12 months

- Waiving assessments of penalties and late fees

- Halting all foreclosure sales and evictions of borrowers living in Fannie Mae or Freddie Mac-owned homes until at least May 17, 2020

- Suspending reporting to credit bureaus of delinquency related to forbearance,

- Offering loan modification options that lower payments or keep payments the same after the forbearance period

Homeowners can find out if they have a Fannie Mae-owned mortgage by visiting www.KnowYourOptions.com/loanlookup or Freddie Mac at https://ww3.freddiemac.com/loanlookup/.

Last but not least, we put together a few resources we find most helpful to build resilience and a positive outlook during this difficult time.