Transition Planning

Every person will experience at least one major life transition and the likelihood that more than one at a time will be experienced increases with age.

Some of the traditional events you may experience in your life include:

- Inheritance

- Loss of a parent

- Death of a spouse

- Divorce

- Major career change

- Retirement

- Sale of a business

- Insurance settlement

- Pro sports or entertainer contract

- A major change in health

Transitions thrust individuals and families into a position where what was once considered stable is suddenly in flux.

Traditional financial planning definitely covers the bases when it comes to important technical topics such as taxes, investments, cash flow, and estate planning. But that’s only half of the experience of financial change. The other half is the human experience.

The Personal Side of Money

Although the financial services industry is finally acknowledging the profound impact of the personal side of money—what has often been called the “soft side” of our business—Silver Oak has been empowering our clients through the full spectrum of transitions for many years. We know from decades of first-hand experience that the personal side is just as important as the technical side. In fact, it’s typically the personal, more emotional side that drives decision-making, not the logical side. People tend to decide with their hearts and then rationalize or validate their decisions through additional thinking and logic.

There is a whole universe of experience, thought, and feeling that drives the process of adapting to financial change. At Silver Oak Wealth Advisors, we have a unique way to address it and integrate it.

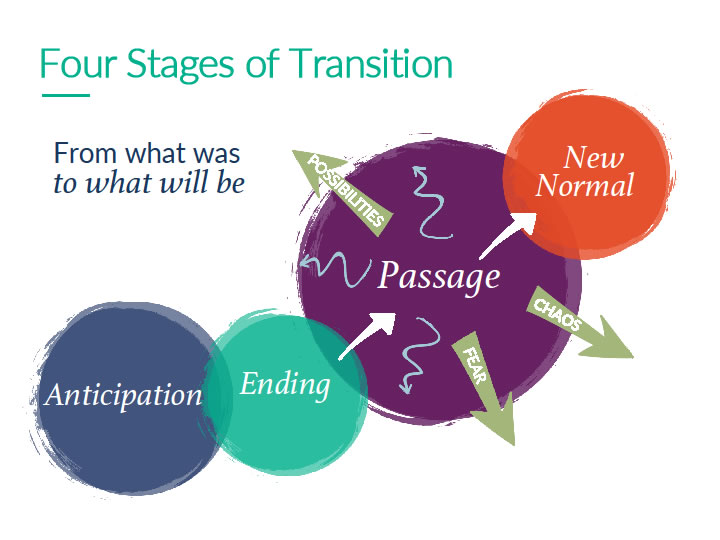

Research on transitions has historically shown that they begin with an ending, and some of them do. But when it comes to events that you are aware of prior to them actually occurring—let’s say you know that you will retire in two years—your thoughts, and even your behavior, your relationships, and decision-making can begin to shift. In other words, that personal side—that other half of your relationship to money—can be dramatically affected with just the simple awareness that the actual event is approaching.

At Silver Oak Wealth Advisors we consider the Anticipation of an event to be a legitimate stage of transition, and we have tools and processes to guide and support our clients in that early stage.

Anticipation, Ending, Passage, and New Normal—all four stages of transition—have their own set of struggles that frequently occur. From problems with thinking to exhaustion, to emotions, and even a complete lack of emotion and numbness—transitions can profoundly affect how we think, feel, and act. Because we are all unique, our experience won’t necessarily follow the typical pattern.

New choices can be overwhelming. The struggles that might emerge for you can cause problems that range from mildly inconvenient to disastrous. For instance, a change in marital status can cause an identity crisis; a large windfall can cause a complete breakdown in core values. Whatever the issue, we now have ways to help keep people in transition safe and support them when they are struggling.

As Certified Financial Transitionists, we have a discovery process based on deep listening and allowing the client’s concerns to drive the process.

In addition to handling transition struggles, we have a unique approach to something we call transition Flow. We borrowed the idea of flow from a Hungarian psychologist whose book, Flow: The Psychology of Optimal Experience, posits that we are happiest when in a “flow state.” A flow state is similar to what you may have heard called “being in the zone.”

We have tools to enhance the experiences of clients whose transitions are going smoothly and who are energized by their life event.

People experiencing Flow in their transitions:

- Have clarity of thought.

- See stress as a challenge rather than a debilitating obstacle.

- Make decisions that serve them well.

Their mindset is that whatever is happening can be used to enhance their lives, and they can find growth opportunities in even the most traumatic circumstances. We encourage this type of “stress-is-enhancing” mindset and aim to cultivate it in ourselves and our clients.

The Certified Financial Transitionist program has trained us to identify not only where someone is in their transition, but their state of being in the midst of their transition.

Whether things are flowing smoothly or are very bumpy, we are trained to know what is needed to get the most from the experience. We provide protection for that passage.

Transition expertise matters. We know that because we see the difference that it makes, every day.

Let’s have a confidential conversation about what you are experiencing in your life.